Turning 65 is a significant milestone—not just for birthdays, but also for healthcare decisions. For many residents in Prescott, AZ, this age marks the first opportunity to explore Medicare, a federal health insurance program designed to help manage the cost of medical care during retirement.

But understanding Medicare isn’t always straightforward. Between the parts, plans, and enrollment windows, it’s easy to feel overwhelmed. Whether you’re preparing for retirement, continuing to work, or assisting a loved one, having a clear understanding of your Medicare options can help you make more confident and informed choices. That’s where speaking with an independent Medicare advisor in Prescott can make a real difference—offering guidance tailored to your specific needs, without the pressure of one-size-fits-all solutions.

📍 If You’re in Prescott, Arizona

Turning 65 and navigating Medicare? Local guidance can make the process clearer and more personal. Speaking with someone who understands the Prescott healthcare landscape can help you choose plans that align with nearby providers and services.

For Medicare-related questions or support, visit or contact:

Address:3623 Crossings Dr, Ste 277, Prescott, AZ 86305

Call: (928) 379-0172

Email: edmcmahan2020@gmail.com

Why Medicare Matters at 65

When you reach 65, you typically become eligible for Medicare. It’s a major transition point for your healthcare coverage—especially if you’ve had employer-sponsored insurance up until now. Medicare is not just one single plan but a collection of parts that work together to provide medical coverage.

Understanding how each part works can help you determine what you need and avoid unnecessary coverage gaps.

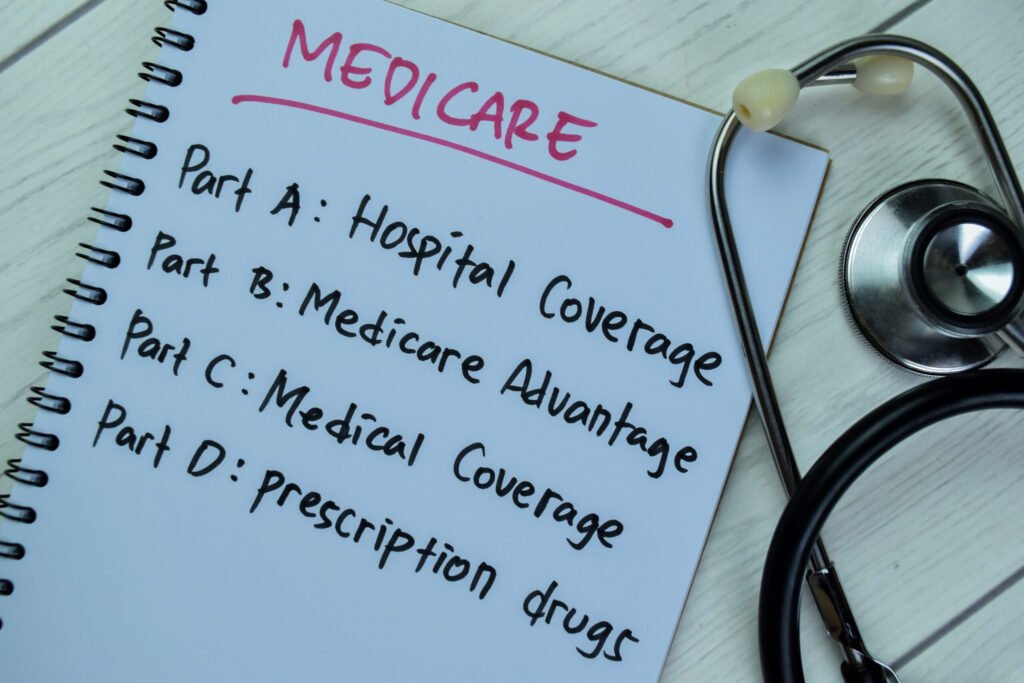

A Breakdown of Medicare Options

Medicare is generally divided into four key parts:

1. Medicare Part A – Hospital Insurance

This helps cover inpatient hospital stays, hospice care, and some skilled nursing facility care. Most people don’t pay a premium for Part A if they have paid Medicare taxes during their working years.

2. Medicare Part B – Medical Insurance

Part B helps cover outpatient services such as doctor visits, preventive care, lab work, X-rays, and some home health services.

Together, Parts A and B are known as Original Medicare, which is administered directly by the federal government.

Do You Need More Than Original Medicare?

Original Medicare covers many services, but it doesn’t pay for everything. It typically doesn’t include coverage for prescription drugs, routine dental or vision care, or hearing aids.

That’s where additional options come in:

3. Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies and must provide at least the same benefits as Original Medicare. Many of these plans include additional features like:

- Prescription drug coverage

- Routine dental and vision care

- Wellness benefits and health management tools

These plans may be a suitable option for individuals who prefer to have all their coverage under one plan.

4. Medicare Prescription Drug Plans (Part D)

If you opt for Original Medicare and need prescription drug coverage, you can consider enrolling in a standalone Part D plan. These plans vary in terms of the medications they cover, so it’s worth reviewing them carefully based on your current prescriptions.

Medicare Supplement (Medigap) Plans

Another option to consider is a Medicare Supplement plan, often called Medigap. These plans work alongside Original Medicare to help pay for costs like copayments, coinsurance, and deductibles.

It’s important to note that Medigap plans do not work with Medicare Advantage plans—you’ll need to choose one or the other.

What If You’re Still Working at 65?

Many people in Prescott continue working past 65 and receive group health insurance from their employer. If that’s the case, you may have the option to delay enrollment in certain parts of Medicare without penalty.

This decision should be based on how your current group insurance compares to Medicare’s coverage, and whether your employer plan will remain active once you’re eligible for Medicare.

How to Make the Right Choice

Choosing the right Medicare path is personal. It depends on your:

- Current health needs

- Prescription medications

- Preferred doctors or hospitals

- Travel plans or seasonal residence

- Budget and risk tolerance

With so many options available, it’s a good idea to seek help from someone who understands Medicare inside and out and who can offer insights based on your personal circumstances—not just what’s available on paper.

Why Local Help Matters in Prescott, AZ

Navigating Medicare with the guidance of someone familiar with the healthcare landscape in Prescott can make a significant difference. Local insight can help you understand which plans are most accepted by nearby hospitals and which options are most popular among other seniors in the area.

Instead of relying solely on national hotlines or websites, consider speaking with someone locally who understands the area-specific challenges and healthcare provider networks.

How to Prepare Before You Enroll

Before making any decisions, it helps to:

- Make a list of your current medications

- Review your existing health insurance

- Write down your preferred doctors and specialists

- Understand your monthly budget for health expenses

- Learn key enrollment deadlines

Even if you don’t need a lot of medical care today, preparing ahead of time ensures that you’re protected in the future—and can save you from penalties or coverage gaps.

You Don’t Have to Figure It All Out Alone

Medicare decisions don’t have to be stressful. There are resources and licensed professionals in Prescott who can help you explore your options without pressure. Whether you’re enrolling for the first time or reviewing your current plan during open enrollment, getting personalized guidance may help you feel more confident in your choices.

FAQs

1. Do I need to enroll in Medicare when I turn 65 if I still have employer insurance?

Not always. If your employer provides credible coverage, you might be able to delay certain parts of Medicare without penalty. However, it’s important to compare both options carefully to avoid unexpected costs later.

2. Can I get dental and vision coverage through Medicare?

Original Medicare doesn’t cover routine dental or vision care, but many Medicare Advantage plans offer these benefits. It’s worth exploring those options if you want more complete coverage.

3. What’s the difference between Medicare Supplement and Medicare Advantage plans?

Medicare Supplement (Medigap) plans work with Original Medicare to help cover costs, while Medicare Advantage plans replace Original Medicare entirely and often include extra benefits. Your choice depends on your healthcare needs, provider preferences, and lifestyle.

📍 If You’re in Prescott, Arizona

Turning 65 and navigating Medicare? Local guidance can make the process clearer and more personal. Speaking with someone who understands the Prescott healthcare landscape can help you choose plans that align with nearby providers and services.

For Medicare-related questions or support, visit or contact:

Address:3623 Crossings Dr, Ste 277, Prescott, AZ 86305

Call: (928) 379-0172

Email: edmcmahan2020@gmail.com